Disasters strike all the time, often without warning. As a search and rescue (SAR) responder, you must always be ready for the next call. Although

Introduction: In the pursuit of maintaining a vehicle’s aesthetic appeal and resale value, Paint Protection Film (PPF) has become a go-to solution for drivers worldwide.

Hearthstone is quickly becoming one of the top Esports titles in the world. The game combines elements of collectible card games, battle arena-style gaming, and

More than 500 million people suffer from diabetes, and the worst thing is that a large percentage of them die from complications of the disease.

Fitness Tracker Demand to Surge with Growing Popularity of Smart Watches In recent years, globally rising health consciousness has propelled the demand for fitness trackers

When choosing a childcare centre, nothing is more important than your child’s safety. You need to ensure that your child is well cared for throughout

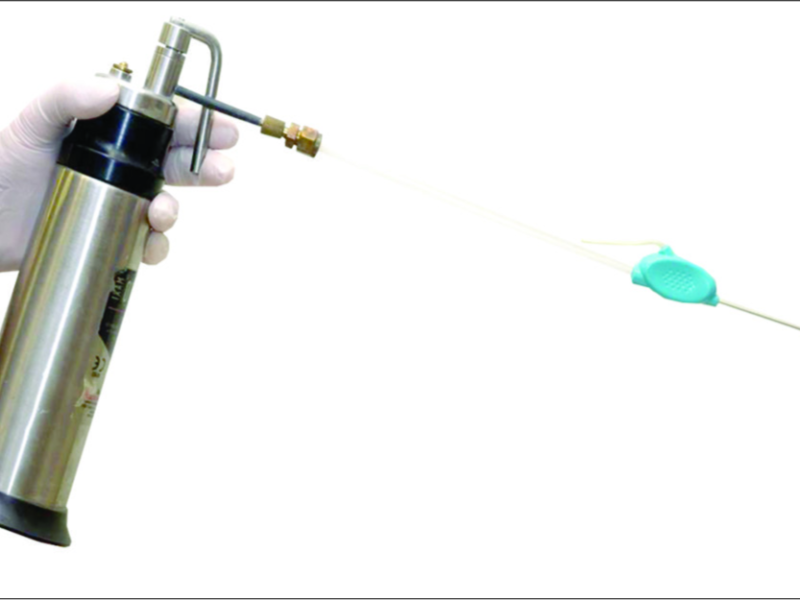

Intralesional (IL) cryotherapy-CryoShape is a novel treatment method for keloid scars, in which the injury is solidified from inside. Intralesional CryoShape for the Treatment of

Bundling is something other than an approach to get your item from A to B – its additionally an unbelievably important client touch point. How

Here we are going to discuss A Short History of Solar Panels. Sunlight based vitality starts with the sun. Solar Panels (otherwise called “PV boards”)

Finding a conventional advance with terrible credit can feel a great deal like looking for the famous needle in a sheaf — in obscurity. Best

The chance that you need to be a designer, make applications or figure out how to code, at & How it that point, Java is

Such a Large number of learners and competitors rush to ignore (and now and then overlook) about the bodyweight exercise. Here we are going to

What are Blood Pressure Treatment Guidelines? Therapeutic services suppliers frequently experience patients with blood pressure treatment guidelines, particularly systolic, who travel every Slimlinie Keto which

Different Things to Know About Men’s Haircut to Open a Barber Shop are available here. The individual consideration industry is blasting, and men are significant

While there are various styles of hairstyles, there are essential things that are utilized to make them. 3+ Basic Fundamental Haircuts for Men & Women